Oct 12, 2020

Vehicle-to-Grid: Energy Storage on Wheels

To limit the global rise in temperature to below 2°C as per the Paris Agreement, the global energy systems must undergo major transformations from a fossil-based system to a more energy efficient one based on renewables. But such a shift is not without challenges. The Vehicle-to-Grid (V2G) technology could very well play an essential role in overcoming them, enabling vehicles to simultaneously improve the efficiency of electricity grids, reduce greenhouse gas emissions for transport and accommodate low-carbon sources of energy.

IRENA’s global roadmap for the energy transformation – REmap – suggests that renewables could contribute to two-thirds of the primary energy supply by 2050. The share of electricity in the total final energy consumption will increase from the current 20 % to 40 % by 2050. At the same time the share of renewable energy in the power sector will need to more than triple compared to current levels – where variable renewable energy (VRE) sources such as solar and wind will account for 60 % of total electricity produced (Power System Flexibility for Energy Transition, IRENA, 2018). But transforming our energy system towards one dominated by renewable energy comes with some challenges, as high VRE shares increase system requirements for balancing supply and demand, also called flexibility requirements.

Balancing supply and demand

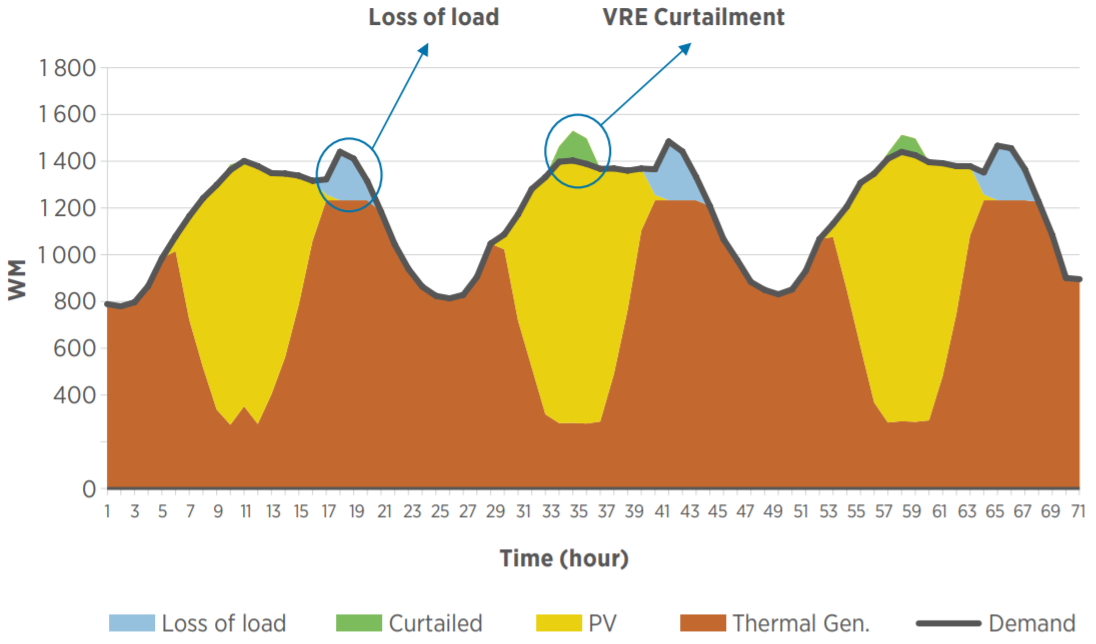

It occurs that more electricity than needed is being supplied due to technical constraints on the ability of thermal generators to further reduce their output. Such a situation of overgeneration can trigger the need to disconnect (curtail) generation from VRE to maintain frequency at its nominal value (Greening the Grid: The Role of Storage and Demand Response, Denholm et al., 2015). Figure 1 illustrates a typical hypothetical dispatch where one can observe the characteristic duck-shaped curve of the net load in power systems with high solar shares.

Referring to the above figure, when the total produced electricity is less than the demand some load needs to be disconnected. This situation is called Loss of Load. In order to address the events of curtailment and loss of load, several measures are proposed (Presentation at GIVAR meeting ‘Thermal Power Flexibility in China, Xiang, 2017):

- improvement of operational practices,

- implementation of competitive wholesale energy markets,

- modernisation of the grid infrastructure,

- implementation of a major retrofitting programmes to increase the flexibility of existing conventional coal units,

- implementation of demand side programmes with a focus on interruptible loads,

- investments in pumped hydro,

- roll-out of EVs.

This article analyses the ability of EVs as flexibility assets with a special focus on V2G services, that can help enhance power system flexibility to integrate higher share of VRE.

From Grid-to-Vehicle to Vehicle-to-Grid

According to the sustainable development scenario projected by IEA, the number of electric vehicles (EVs) will rise to a massive figure of around 245 million in 2030 – more than 30 times above current level. The scenario incorporates the targets of EV30@30 campaign, launched by Clean Energy Ministerial (CEM), to collectively reach a total share of 30% of EVs in the global automotive market by 2030 in all transport modes except two-wheelers (EV30@30, increasing uptake of electric vehicles, CEM, 2020). The bi-directional nature of batteries (i.e. charging and discharging) can prove as biggest flexibility asset on wheels in future. To lower the impact of EVs charging on power system’s supply-demand balance, Grid-to-Vehicle or V1G technology has been rolled out. Using Smart Charging, rate of charging could be increased to utilise the maximum VRE production. In the event of overgeneration, while lower VRE production, the charging rate, power and duration of charge can be adapted to reduce the load on the grid.

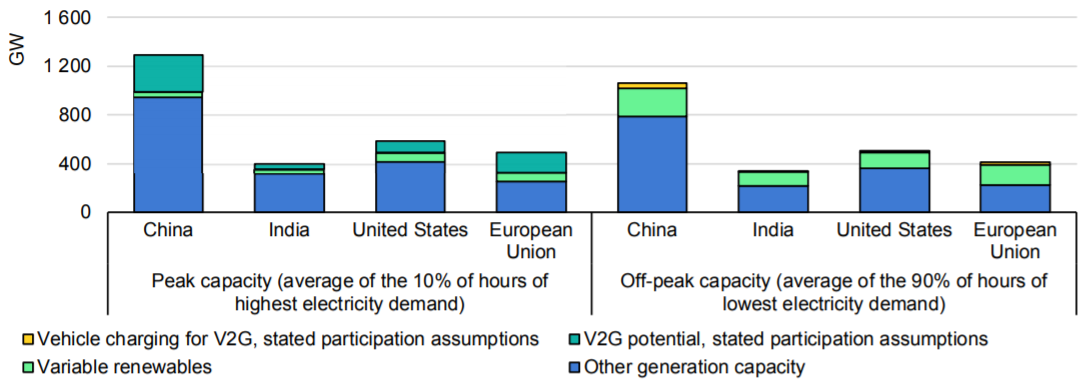

V2G services on the other hand refer to injecting power back into the grid from the vehicle batteries to avoid Loss of Load events. V2G technology could aid turning EVs from an energy consumer into a producer or prosumer helping to shave peak demands and save money by avoiding running costly Peak Power Plants (PPP). It also enables energy to be fed back to the power grid from the battery of an electric car. With V2G technology, a car battery is discharged based on different signals — such as energy production, demand at that moment of time, electricity market prices, etc. (CHAdeMO, 2020). Meeting peak demands in an electricity system typically requires 15-25% of generation capacity beyond the capacity needed to meet electricity demand for 90% of the hours of lowest demand. This accounts for about 600 GW of capacity to meet peak demand across China, European Union, United States, and India combined. The projected EV energy storage capacity (i.e. the cumulative battery capacity of the EV fleet) in these regions by 2030 in the Sustainable Development Scenario amounts to 16 000 GWh. The challenge is whether a part of this large, stored energy could be harnessed to help meet the peak demands (Global EV Outlook 2020, IEA, 2020).

Challenges to overcome

Some major implementation and technical challenges faced by V2G are the following:

- There is an active debate on how V2G strategies affect the life and health of EV’s battery. Most research claims that a maximum of 60-80% of the nominal battery capacity can be drawn without premature degradation of the battery. However, more research and tests are needed to identify the parameters that influence the degradation of batteries (Global EV Outlook 2020, IEA, 2020).

- Due to the conversion from direct to alternative current during discharging, 10% (for 8 kW chargers or more) to 20% (for 3 kW chargers) of the energy being drawn from the battery can be lost (Test and Modelling of Commercial V2G CHAdeMO Chargers to Assess the Suitability for Grid Services, Zecchino et al., 2019).

- In case of light duty vehicles, due to a range of discharge rates from 3 kW to 10 kW, not all the usable battery capacity can be discharged during the peak demand periods. Overall, the limitations due to discharge rates make around quarter of the total battery’s capacity not available for V2G applications (Global EV Outlook 2020, IEA, 2020).

- Currently the charging standard that readily supports V2G is CHAdeMO, which has bidirectional capability and was introduced first in Japan. CHAdeMo is now available in all major EV markets including China, Europe, and North America. Until now, only 12 vehicle manufacturers (OEMs) have participated in V2G projects with Renault, Nissan, and Mitsubishi clearly dominant representing more than 50% of V2G projects. However, more standards (CCS, GB/T, etc.) need to get on board for greater adoption of V2G among other OEMs around the globe (CHAdeMO, 2019).

- One of the major challenges faced with such business models is the standardisation of the compensation from the electricity markets to the mobility counterparts. There are also no regulatory frameworks as it is a new business area, however there is optimism that by 2030 there will be sufficient developments from the government side to address such inefficiencies.

Harnessing EV battery capacity

Accounting for all the above limitations, around 5% of total global EV battery capacity could be available for V2G, unlocking several hundreds of gigawatt-hours to meet peak demand (Global EV Outlook 2020, IEA, 2020). Despite being a very small share of the total EV battery capacity by 2030, the total technically available potential for V2G deployment exceeds the additional generation capacity required to meet peak demand in almost all major EV markets (Figure 2). The dark green section on the peak capacity side in all the regions is the technical available potential of V2G, which is significantly greater than the additional flexible generation capacity required otherwise. It is also projected that the battery potential addition per year will be about 2000 GW globally by 2030 (Global Energy Perspective 2019, McKinsey, 2019), an amount well higher than the flexible generation capacity needed during peak periods.

EV sales were estimated at around 2.1 million in 2019. There is a projection of over a 100 million EVs by 2030 and over 1.4 billion EVs by 2040 (BNEF EVO Report 2020, Bloomberg NEF, 2020). With the current battery costs of 156$/KWh (Bloomberg NEF, 2019), there is also a valuable business case in harnessing this potential as it would help lower the electricity storage costs and serve for other purposes such as deferring the transmission and distribution investments. The V2G technology also helps create a synergy between the transport sector and the electricity system by exploiting the business models that combine mobility and the electricity markets.

When it comes to standardisation of the V2G technology, Japan currently serves as a role model as it is the only country that today already has a standardised V2G Protocol. This also calls for the standardisation in the design of the EV charging systems as well as the battery packs by the battery manufacturers and the automotive OEM.

V2G projects deployed worldwide

With the increased focus in the V2G technology, a lot of companies see in it a big potential in the future. As of July 2019, roughly 50 V2G projects have been implemented across the globe. Companies aim indeed at determining the most suitable business models for all the stakeholders including the EV owners, charging developers, utilities and automotive OEMS (V2G Global Roadtrip: Around the World in 50 Projects, Innovate UK, 2018).

The German power utility E. ON is currently working with Nissan on the business model for V2G services, distributed energy generation and renewable energy systems (V2G: Everything You Need to Know, Virta Global, 2020). Similarly, Volkswagen sees an enormous potential in EVs. They project that by 2025, they will have 350 gigawatt hours of energy storage at their disposal through their car fleets thus bringing down the cost of energy storage (Electric Vehicles, Volkswagen, 2020).

In September 2019, a similar approach was seen with Nissan and EDF agreeing to jointly develop V2G technology as part of their new agreement to serve the United Kingdom, France, Belgium, and Italy. Also, in the same year, EDF and the well-known California based company, Nuvve launched a joint venture called Dreev focusing on the development of V2G technology (EDF Group, 2019).

Currently, the leading players known to these markets are Nuvve, eMotorWerks, Plugshare, Greenlots and Kisensum. Nuvve provides turnkey solutions to deploy, supply, Install and manage chargers as well as providing V2G services. Greenlots develops a software platform that manages and communicates with chargers to shift EV charging load and balance the power grids. Kisensum offers a fleet and energy management software platform that allows fleet managers to control and optimise their grid services.

In conclusion, a high penetration of EVs in the future transport sector is inevitable, which calls for high demands of electricity from the grids. V2G technology is one of the few viable flexibility assets that could support the grids, help avoid peak power plants usage, and at the same time benefit the EV users financially. The deciding factor for its adoption would be the development of V2G enabling infrastructure, and its integration in flexibility markets in the foreseeable future. This certainly is a big challenge but achievable with EV stakeholder’s collaboration and government level involvement!

By Johan Söderbom, Thematic Leader for Smart Grids and Energy Storage at EIT InnoEnergy

Johan Söderbom has 25 years experience in the utility business. He worked 20 years for the Northern European utility Vattenfall where he served several roles within the R&D on Smart Grids, e-Mobility and customer related products. He then joined RISE (Research Institutes of Sweden) has Head of the Section for Electric Measurement Technology. Since August 2019, Johan is now Thematic Leader for Smart Grids and Energy Storage at EIT InnoEnergy, in charge of all strategic technology and business perspectives in these specific fields. Besides his role at EIT InnoEnergy, Johan has been engaged in several national and European projects within the smart grid area, in addition to several advisory board roles both at a national and international levels.

More EBA250 news

The European Battery Alliance (EBA) welcomes today’s announcement by Executive Vice-President Stéphane Séjourné on…

Vulcan Energy has reached a major milestone with the Final Investment Decision (FID) for…

Today, a joint High-Level Ministerial Meeting of the European Battery Alliance (EBA) and the…

We are pleased to announce that today we have signed a Memorandum of Understanding…

The European battery sector does not need a new strategy – it needs a…

U.S.-based battery innovator Lyten has signed binding agreements to acquire all of Northvolt’s remaining…

The European Battery Alliance (EBA) welcomes the European Commission’s swift decision to award €852…

Last week, the European Commission published the Clean Industrial Deal State Aid Framework (CISAF),…

We are pleased to welcome Emma Nehrenheim as new Managing Director of the European…

As Europe’s battery cell manufacturers face increasing competitive pressure, EBA250 remains actively engaged in…